“Someone’s sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffett.

This quote forms a foundational pillar of long-term investment philosophy. In life just as in investing you must think about the grand trajectory of things. Overall, there is no better time to start thinking about that journey than today. A tree takes time to grow, and so will most smart investments. Start early, be patient, and let your money grow.

During volatile times, such as this period we currently find ourselves in, many investors get spooked and begin to question their long-term investment strategies. This is specifically true for novice investors, who are tempted to pull out of the market altogether and leave their capital in cash until they believe it is safe to go back in.

The thing to realize is that market volatility is inevitable. It’s the nature of the markets to move up and down over the short term. Trying to time the market is extremely difficult. One solution is to maintain a long-term horizon and ignore the short-term fluctuations.

What Is Volatility?

Volatility is a statistical measure of the movement of a market to rise or fall sharply within a short period of time. The volatility of different types of investments will vary based on how much and how often their prices or returns fluctuate.

For example, the Standard & Poor’s 500 Index (S&P 500) may have a target volatility of 15% over a rolling five-year period. While a more stable investment, such as a Government Bond, will typically have volatility of nearly zero because the return never varies.

When does volatility strike?

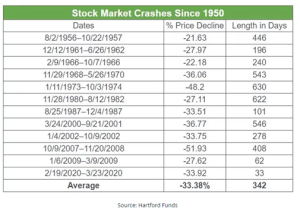

Since 1950, the S&P 500 index has declined by 20% or more on 12 different occasions. The average stock market price decline is -33.38% and the average length of a market crash is 342 days.

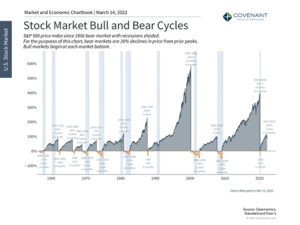

However, and this why time spent in the market is key to a long-term plan, the period that follow these crashes tend to be strong and last much longer. A you will see in the below graph the size of the orange shaded region (market decline) and the size of the grey shaded areas, which represent market recoveries.

What Should I Do About A Decline In My Investment?

Not panic! Market declines will happen but if your investment was made with long term goals in mind then your investment portfolio is designed to endure only as much risk as you must for your goals. Your investment plan should be tied to your goals and balanced to allow you to remain focused on the future. Your portfolio structure should be designed to provide the long-term return you need but conservative enough, so you don’t panic and change course when the market dips, corrects, or crashes.

From the above you see markets aren’t stable or steady over the short term but perform consistently well over the long term. That’s why it’s so important to stick to your investment strategy.

And most importantly If you feel that your investment isn’t preforming in line with your long-term goals remember that the goal was to Start early, be patient, and let your money grow.

If you are looking to get investment advice, contact Alan Buckley on alan@castlecapital.ie